1 INTRODUCTION

With the increasingly competitive business

environment, companies seek to improve their operations, so that profit is

optimized to reduce waste. To manage efficiently requires effective planning,

for this, it is necessary to have a perspective of the future conditions in

which the company will operate, and how the elements that condition this

perspective relate to each other [1].

To ensure competitive advantage, companies

rely on systems that allow them to expect how resources should be used. These

systems make it possible to extract information through large volumes of data

to provide insights. Thus, data mining helps in the extraction of information

from the database, being a great ally in planning corporate strategies, having

the ability to promote in managers a more adequate understanding of the current

situation of the company, thus allowing through insights the generation of

strategies to increase sales, as well as determining the direction to be

followed [2].

Sales is the core activity from a business process. Companies

record and document every transaction as a cycle in financial management. Sales

transaction data histories can be used to predict the possibility of sales

transactions that will occur in the future [3]. companies have invested

in decision support systems to explore scenarios based on the historical data

of their transactions.

Sales prediction is the

process of organizing and analyzing information in a way that makes it possible

to estimate how sales will be [2]. Thus, information technology is

transforming the way businesses are conducted. Data mining for sales prediction

is utilized for capturing the tradeoff between customer demand satisfaction and

inventory costs. An essential and inexpensive way for each company to augment

their profits, decrease their costs, and achieve greater flexibility to changes

[4].

1.1 OBJETIVES

The objective of this study

is to analyze the sales database to predict the number of sales. This research

uses a data mining-based approach for sales prediction. In this way, this study

proposes an improvement in financial management.

1.2 JUSTIFICATION

Currently,

sales transaction data histories are used to predict the possibility of sales

transactions that will occur in the future. However, this financial management

has no assertive predictability. Therefore, the identification of relevant

attributes and correlations for sales prediction becomes a fundamental factor

for competitive advantage. Decision-making systems help companies to augment their profits, decrease

their costs, and achieve greater flexibility to changes [4].

1.3 NEGATIVE SCOPE

It is not the objective of this study to generate a sales

prediction application or integration for the company's use, nor will we impose

the use of the metrics obtained or put them into practice to validate the

results obtained during the study.

2 THEORETICAL

FOUNDATIONS

2.1 DATA MINING

Decision making based on

experience and intuition alone is not always sufficient for solving complex

problems. One solution to this problem is the use of data mining algorithms to

assist in the decision-making process [5]. Data mining can be

understood as the process of analyzing large amounts of data in order to find

patterns, correlations, and anomalies to predict outcomes that, given the

volume of data, would not be easily discernible by human reason alone.

The data mining process

takes place in several steps, as a kind of filtering, so that in the end only

the information that really matters remains. The steps of this process can be

summarized in: 1) Business Understanding, 2) Data Selection, 3) Data Cleaning,

4) Data Modeling, 5) Process Evaluation, and 6) Execution. It is through these

steps that data mining surveys large volumes of data and relates them in a

useful way, thereby capturing the information relevant to the user's

objectives.

The general data mining

techniques can be summarized into five: Classification (consists of dividing

data into categories and the most commonly used algorithms for this purpose are

decision trees, regression and neural networks); Estimation (is estimation of a

probable value, compared to preexisting data and neural network and regression

algorithms can be used); Prediction (is the evaluation of a future data, taking

historical data and behavior as a parameter, and neural network, decision trees

and regression algorithms can be used); Cluster Analysis (aims to form groups

of elements that are more homogeneous among themselves, and is performed by

specific statistical algorithms, neural networks, and genetic algorithms), and

Affinity Analysis (seeks to recognize patterns of concomitant occurrence of

certain events in the analyzed data, using association rules most of the time) [6].

2.1.1 Algorithms

In this

research, some data mining algorithms were selected and will be described

below:

·

Linear Regression: model that considers the connection of responses to the

variable to be a linear function of some parameters, and this is done to ensure

generalization - giving the model the ability to predict outputs for inputs it

has never seen before.

·

Ridge CV: also known as L2, it’s a model fit method used to analyze any data that

suffers from multicollinearity. This technique discourages overfitting the data

in order to decrease its variance. As the L2 penalty is disproportionately

larger for larger coefficients, Ridge regularization causes correlated features

to have similar coefficients.

·

Support Vector Regression (SVR): supervised learning algorithm used to

predict discrete values that seeks to find a best-fit line. A

best-fit line is the hyperplane that has the maximum number of points. A big

benefit of using SVR is that it is a non-parametric technique.

·

LSTM: is a special kind of recurrent neural network (RNN), which

can remember information for much longer time periods and can capture complex,

nonlinear relationships due to its recurrent structure and gating mechanisms

that regulate the information flow into and out of the cell, and its large

capacity to deal with sequential data. Contrary to the classical neural

networks, LSTM has feedback connections that enable the processing of input

sequences of arbitrary length and is commonly preferred in classifying,

processing and making predictions based on time-series data [7]. It means that LSTM is a

good approach to use for sales forecasting. That is the reason why this was one

of the algorithms choosed.

·

ARIMA: is a combination of A.R. and M.A. models, along with

differencing. In Autoregressive models (A.R.), predictions are based on past

values of the time-series data, and in Moving Average models (MA), prior

residuals are considered for forecasting future values. The model is generally

favored for its flexibility to various types of time-series data and its

predicting accuracy [8]. For this reason, this was one of the

techniques selected to execute the sales forecasting.

2.1.2 Ensemble Methods

Ensemble

methods are a technique that use multiple learning algorithms and combine them

to achieve improved results on the predictive performance. Unlike other

techniques that will find a single model to make predictions for a specific

problem in a space with multiple hypotheses, ensembles will combine a - finite

- set of alternative models for that. This combination of multiple models

allows the elimination of variance, and because of that, increasing the

accuracy of predictions.

The

ensemble methods are divided into two categories: sequential ensemble

techniques, which generate base learners in a sequence; and parallel ensemble

techniques, which generate base learners in a parallel format. The first one

promotes dependence between the base learners, while the second one,

independence.

The

most popular ensemble methods are (i) boosting, (ii) bagging and (iii)

stacking. (i) Boosting is a technique that learns from mistakes made by the

previous predictor, in order to make better predictions. (ii) Bagging will

improve the results of the model through decision trees, reducing variance; and

(iii) Stacking, a technique that allows a training algorithm to ensemble other

similar learning algorithm predictions. The effectiveness of these methods,

throughout the years, has been proved undeniable, including in the improvement

of predictive models for sales forecasting [9].

2.2 SALES FORECASTING

Sales forecasting consists of the calculation or the sequence

of steps that the decision maker performs, based on a sales history and

understanding of the consumer, in order to predict the results of their sales.

The forecast gives insight into how a company should manage

its workforce, resources and cash flow, and also helps enterprise planning and decision-making

regarding operations, marketing, sales, production and finances in an effective

way. It also increases the commercial competitive advantage, as decision makers

will make the best choices using the information obtained through its

mechanism.

A sales

forecasting mechanism allows the organization to improve market growth with

greater revenue generation, and to create one with a high level of accuracy and

reliability is one of the biggest challenges. To achieve this, data mining

techniques are very effective in turning huge volumes of data into useful

information for sales forecasts [10].

2.2.1 Coupons Sale

Wholesale and retail

consumers normally, when making a purchase, get the change from their purchase

in return in bills and/or coins. The case study discussed here handles shopping

change differently. When buying a certain product in a store, the change

received by the customer will be provided as a complement through a virtual

coupon, which represents the change for a certain sale. In this way, the

customer will be getting his change in a virtual score format, being able to

compete for prizes, in which the higher the score, the greater are the chances

of winning. In this context, sales are represented by this additional change,

which can vary between R$0.10 and R$10.00.

2.2.2 Times Series Forecasting

A time series is a

collection of observations made sequentially over time. The order of the data is

a fundamental characteristic of this type of data since the dependency between

them is used for analysis and modeling [11]. Time series analysis

(TSA) refers to methods that analyze the characteristics of the data, to

extract useful statistics from them. Time series forecasting is often used to

predict future expected values of the data to be recorded. Time series analysis

has the undoubted advantage of being simple and effective, since the pertinent

outcomes can often be interpreted intuitively [12].

2.3 RELATED WORKS

As mentioned earlier, the company does not use its daily,

monthly, and yearly sales prediction based on the many variables that can

affect the sales quantity, such as store location, the day, month and time of

the sale, the value of the sales coupon, among others. This directly affects

the accuracy of the sales quantity in a given period, which can hinder

decision-making on various aspects of the company.

In this context, the study developed by Xiaodan, Yu, Zhiquan,

Qi, and Yuanmeng, Zhao, in 2013, proposes to use the sales forecast, but to

avoid excessive printing of magazines and newspapers, based on previous sales

data [10]. Thus, variables such as the type of store where the

newspapers and magazines are located, demographic data regarding the area where

the store is located, among others, are used. To perform predictability, the

SVR (Support Vector Regression) technique was used, which has the objective of

finding a function that matches the input data with the smallest possible error.

This method was used under the assertion that forecasting techniques such as

multiple regression and linear regression suffer from overfitting problems [13].

A study developed by Passari uses the approach of artificial

neural networks and their techniques to forecast retail sales. This work aims

to use ANNs to create individualized sales forecast models, that is, to analyze

each product individually [10]. Also, this research uses ANNs to

detect relationships among variables that impact the store sales volume (per

product), which is directly related to sales forecasting. Several other

techniques are mentioned, especially time series, but artificial neural

networks are the main focus.

Another research by Zadeh, Sepehri and Farvaresh applies

intelligent sales forecasts for drug distribution companies. In this specific

case, the sales forecasting mechanism proves to be quite effective as the

products of this industry quickly perish and the quality of these products

directly affects human health and life. The objective of this study was to

provide an accurate sales forecast model for auxiliary companies, especially

pharmaceutical companies, in order to predict the sale of products and avoid

costs caused by stock loss and customer loss due to lack of products. As a

main contribution a research, hybrid neural networks were carried out to let

linear ANN model the linear components and let nonlinear ANN model the

nonlinear components and then merge the results from both linear and nonlinear

models, as well as, adding a new method of product grouping that makes use of

past sale data in the prediction of sales and also helps gain more accuracy in

the predictions [4].

Another recent study

considered different machine-learning approaches for time series forecasting.

This research quotes regression approaches for sales prediction that gives

better results than time series methods. Their research provides improvement in

accuracy on the validation and on the out-of-sample data sets using an ensemble

method. The use of a stacking approach makes it possible to take into account

the differences in the results for multiple models with different sets of

parameters [9].

3 MATERIALS

AND METHODS

3.1 DATABASE DESCRIPTION

The database provided was exported from sales data from the

company points program, it has over 1.5 million entries and is composed of two

tables, the first being the sales table and the second a table with data from

the establishment where the sale was executed, where we filtered only the city

and the state.

Each entry in the sales table corresponds to a sale made at a

POS (point of sale), which in this case corresponds to one of the cash

registers of the several commercial establishments that are part of the

program.

For data privacy reasons,

the commercial establishments where the sales were made had their data

encrypted and are identified through an ID. In addition, the base is composed

of the value of the coupon purchased by the customer, the date and time of the

purchase, as well as the city and state in which the establishment is located,

the mentioned fields can be seen in Picture 1.

Picture 1 - Database Fields.

|

FIELD

|

DESCRIPTION

|

TYPE

|

RANGE

|

|

RetailerID

|

Establishment Identifier

|

Int

|

single value

|

|

POS_ID

|

POS Identifier

|

Int

|

single value

|

|

PaymentType

|

Payment Method

|

String

|

Cash or Credit card

|

|

Price

|

Sale value

|

Decimal

|

0.10 - 10.0

|

|

Timestamp

|

Year, month, date and time of sale

|

Datetime

|

2018-05-16 2021-07-15

|

|

City

|

City of the establishment where the sale

was made

|

Text

|

12 Cities

|

|

State

|

State of the establishment where the

sale took place

|

Text

|

2 States (MS and SP)

|

|

Year

|

Year of sale

|

Int

|

2018 - 2021

|

|

Month

|

Month of sale

|

Int

|

January - December

|

|

Weekday*

|

Weekday of sale

|

Text

|

Monday - Sunday

|

|

Day*

|

Day of sale

|

Int

|

0 - 31

|

|

Hour**

|

Hour of sale

|

Int

|

0 - 24

|

*some stores are not open on sunday

**some stores are closed at 10pm

Source: The authors.

3.2 DESCRIPTIVE DATA ANALYSIS

Data analysis was

performed to detect patterns or correlations that might suggest clues for

determining relevant attributes within the project database. Python programming

language was used to accomplish this process, both in determining summary

measures and in visualizing the data.

The variables selected

for this analysis were historical data: Numerical variables: date and time

sales; and Nominal variables: location (city, state).

Summary measures, including

mean, among others, are presented in Picture 2.

Picture 2 - Measures of the variable Price (sales value).

|

VARIABLE

|

PRICE

|

|

Type

|

decimal

|

|

Occurrence

|

1.801735 x 10^06

|

|

Average

|

1.432785

|

|

Std

|

1.161206

|

Source: The authors.

Regarding the variable

'hour', its absolute and relative frequencies were also analyzed. This analysis

was performed so that the hours were divided into periods of the day, that is,

morning, afternoon and evening. Picture 3 shows the distribution of the number

of sales according to the period of the day. The night period was not

considered because there is no record of sales in this interval.

Picture 3 - Measures of the variable Price (sales value).

|

Day period (h)

|

Absolute Frequency

|

Relative Frequency

|

|

6-12

|

737174

|

0.40914

|

|

13-18

|

832072

|

0.46181

|

|

19-24

|

232489

|

0.12903

|

Source: The authors.

Figure

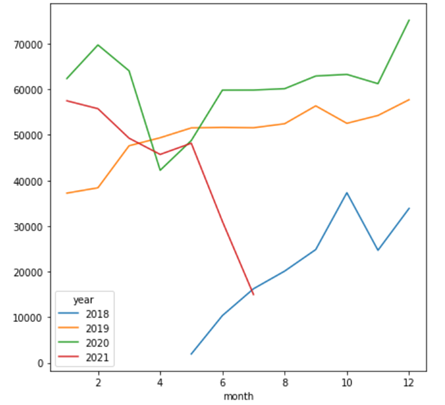

1 allows the indication of the number of sales per month from 2018 to 2021. By

analyzing the data, we observed that the first year had a lower number of sales

due to the fact that it was an unstable time for the solution with a lower

number of stores. Worth to mention that the second semester has a large number

of sales due to the end of year holiday season. Also, we identify that the

number of sales increased with each year observed, as well as that the highest

occurrence of sales took place on Saturdays and Fridays, while the lowest

number of sales occurred on Sunday. Friday and Saturday are the days that we

identify the highest sales numbers, generally 15% to 20% higher than the other

weekdays. And Sunday is usually 50% higher than Saturday, because many stores

are closed.

Figure 1 - Distribution of sales in each year

Source: The authors.

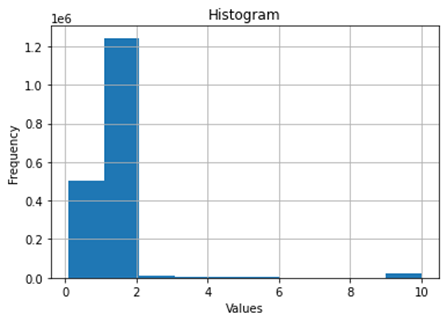

Figure 2 presents a histogram of the analysis about the values of change that

are most frequently purchased according to their price range in Brazilian Real

(BRL).

Another

important measure for analyzing quantitative variables is the scatter plot. By

analyzing the database, it is possible to identify two quantitative measures:

the sales quantity and the sales value. That way, a relationship is created

between the sales price and its respective recurrence. This is important to

identify whether there is a linear relationship between these two variables.

Figure 2 - Histogram of price values

Source: The authors.

The

data analysis identified that the majority of sales are concentrated in values

between R$1 and R$2. It is also possible to conclude that there is a small

recurrence of the values above R$2, appearing to be an almost constant

distribution. Another observation, some outliers that are found in the amount

close to R$10 and R$5. Figure 2 shows the results obtained. Also, it is

possible to conclude that there is a symmetrical distribution of data, with a

small variation in the months of May, June and July. Furthermore, it is

possible to notice that although the prices of the tickets acquired are mostly

between R$1 and R$2, there is a large occurrence of outliers, varying between

R$2 and R$10. This concludes that most outliers are concentrated between R$8

and R$10.

3.3 EXPERIMENTAL METHODOLOGY

The methodology of this

work was carried out according to the steps described below:

·

Step

1:

Selection of models to be used for sales forecasting. Before running the

algorithms, it is necessary to select hyperparameters and also divide the

database.

It is worth mentioning that

initially the holdout method was chosen with the division of training (70%) and

test (30%) mass. However, this method has the disadvantage that the data can be

very biased in the selection of data for training and, therefore, the high

training accuracy does not mean a generalization of learning. And that

generates bad results when the model is used with real data. To solve this

problem, the cross-validation method was used. This method trains and tests the

model with all available data to avoid variance and, thus, ensure more robust

results. The disadvantage of this method is the high computational cost,

however as in this research we have a small database, this was not considered

critical to the point of excluding the use of this method.

·

Step

2:

Represents the choice of metrics for evaluating the performance of the data

obtained. For this, the MSE and the RMSE were chosen. Both are indicated in

problems where predictions that are too far from the real increase the value of

the measure, which makes it an excellent evaluation metric for problems when

large errors are not tolerated, such as in the case of price projections.

Therefore, these two error metrics are described below:

Mean squared error (MSE): The mean squared error is commonly used to

check the accuracy of models and gives greater weight to the biggest errors,

since, when calculated, each error is individually squared and, after that, the

mean of these square errors is calculated.

Root-mean-square error (RMSE): is the measure that calculates "the root

mean square" of errors between observed (actual) values and predictions

(hypotheses) [14].

·

Step

3:

Comparison of techniques for forecasting optimization. In order to analyze the

obtained results, Five algorithms were chosen with two distinct approaches: the

time series prediction and the ensemble method. These techniques were chosen

because they are widely used in various problems and because they are easy to

implement.

·

Step

4:

Hypothesis tests for statistical validation of the results found. In this phase

each method will be compared with the ensemble method to check if there is

improvement of performance or not.

4 RESULTS AND DISCUSSIONS

4.1 RESULTS

To validate the results obtained between all

the analyzed methods the RMSE metric was used as shown in Table 1.

Table 1 - Performance Comparison

|

|

LSTM

|

ARIMA

|

LR

|

SVR

|

RCV

|

ENS.

|

|

RMSE

|

0.99

|

0.104

|

0.131

|

03139

|

0.137

|

0.136

|

Source: The authors.

·

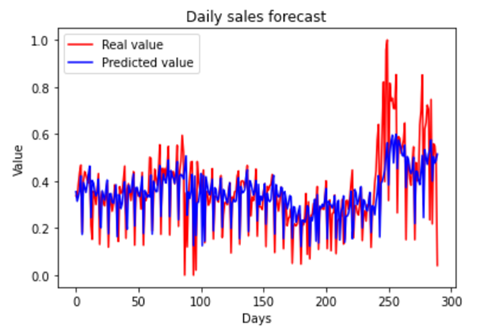

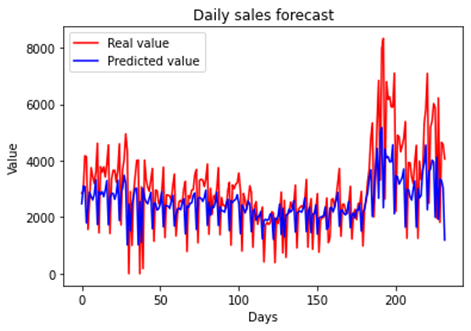

LSTM: One of the approaches used for sales forecasting was

the LSTM neural network. This network was implemented using a 4-layer network,

with 50 neurons each, each one with a 20% dropout. As an LSTM, we are

considering the previous 7 days to perform the current forecast. In addition,

the model has a configuration of 150 epochs of the neural network and a batch

size of 32. As a result, Figure 3 shows a graph of LSTM prediction forecast vs

the real.

Figure 3 - LSTM

forecast vs real

Source: The authors.

·

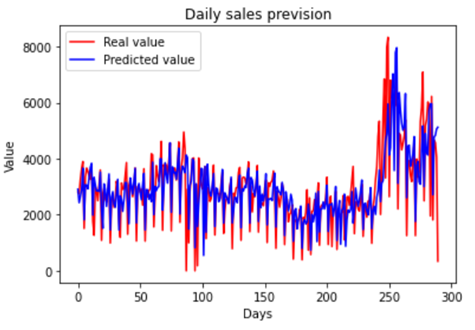

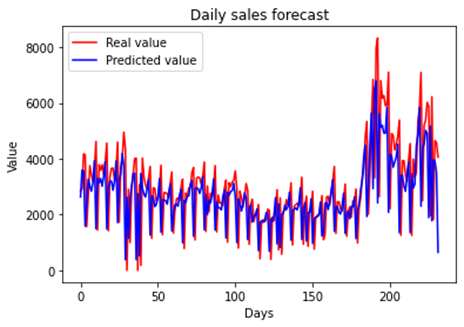

ARIMA: The ARIMA model was implemented because it is widely

used in problems with sales forecasting. In the proposed model, the Grid Search

technique was used in order to obtain the best possible parameters for ARIMA.

As a result, it was found that the best combination of hyperparameters was

(6,1,2). In this combination, the model managed to behave well, being able to

predict some peaks. Furthermore, by normalizing the data, an RMSE of 0.1047 was

found, demonstrating a good forecast result as shown in Figure 4.

Figure 4 - ARIMA forecast vs real

Source: The authors.

·

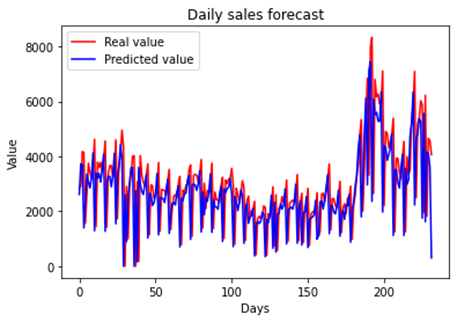

LR: Linear regression is one of the existing classic models

that was used to forecast sales. For linear regression, a Grid Search was also

implemented, aiming at the optimization of parameters. After that, it was

verified that the parameters that best fit with the LR were: ‘fit_intercept’

false, number of jobs equal to 1, and ‘normalize’ also false. As this is a time

series, to carry out the division between training and database testing, it was

necessary to keep the 'shuffle' parameter (responsible for randomizing the

data) as false. Through this configuration, it was possible to obtain a

reasonable model, but one that cannot predict certain sales peaks. The RMSE can

be found in Table 4 and the result graph in Figure 5.

Figure 5 - LR forecast vs real

Source: The authors.

·

SVR: The SVR technique was also implemented using Grid

Search, to obtain the best possible parameters. In this approach, the ‘shuffle’

parameter also remained false. In addition, the best configuration found was

with the following parameters: 'C' being 10; 'epsilon' being 0.0001; ‘gamma’: 1

and finally, the ‘kernel’ parameter being linear. It was possible to observe

that the model is able to predict behaviors that are repeated and reasonably

predicts some sales peaks as can be noticed in Figure 6. The RMSE of this

technique is shown in Table 4.

Figure 6 - SVR forecast vs real

Source: The authors.

· RIDGE: Another technique that was used was

the Ridge. To obtain the best possible parameters, a Grid Search was also

implemented. From that, the following configuration was obtained: 'alpha' being

0.6; 'fit_intercept' being False and the parameter 'solver' being 'sag'. The

Ridge model was successful in predicting some peaks and dips in sales; in

general, this technique was able to make a good prediction on the behavior of

the time series, as shown in Figure 7. Table 1 also shows the RMSE obtained.

Figure 7 - RCV forecast vs real

Source: The authors.

·

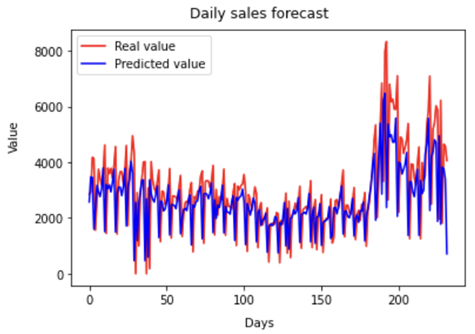

Ensemble

method: The method used was the mean Ensemble

method. That means that the three smaller RMSE algorithms were used as input to

the Ensemble as shown in Table 4. These three techniques were combined to

compose a mean, and this was used as the final result for the combination of

these three algorithms. So, the top

three techniques were: LR (Linear Regression), SVR (Support Vector Machine) and

Ridge, the model was able to reasonably predict the peaks as can be seen in

Figure 8.

Figure 8 - Ensemble forecast vs real

Source: The authors.

·

Hypothesis

tests: an inquiry method about the veracity of a

statement, associated with maximum risk of error. In other words, by definition

a hypothesis test is a rule decision to accept or reject a hypothesis, based on

the information provided by the data collected in a sample and, therefore,

involves a risk of claiming something wrong [15]. The use of hypothesis tests to assess the

significance of differences between the results of the classical algorithms

before and after the ensemble as a means of determining whether they helped

increase the performance of the prediction algorithm.

After

performing the hypothesis tests comparing the algorithms, it was verified that

the H0 hypothesis was accepted. This means that the result was inconclusive,

that is, there is no statistical evidence with a significance of 5% that there

was an improvement using Ensemble.

4.2 DISCUSSIONS

The work developed in 2013

by Xiaodan, Yu, Zhiquan, Qi, and Yuanmeng, Zhao demonstrates an approach using

Support Vector Regression to forecast magazine sales, in order to avoid

unnecessary prints. In this context, the work used SVR as it states that

multiple and linear regressions can cause overfitting in the model. In fact,

SVR was a good strategy for the problem addressed, as it showed good results.

However, the time series approach has not been developed. Therefore, perhaps

the use of time series models is advantageous for this problem, as applied in

this article, which presented more satisfactory results.

Regarding the work

developed by Passari, it is clear that the intent was to generate models to

forecast sales of individual products. In addition, his research uses

artificial neural networks to detect the relation between variables that impact

product sales, allowing him to make a prediction with greater assertiveness.

Thus, the work proposed here did not use this approach to verifying variables

that may impact sales, which can be considered as a future work using neural

networks to detect possible behaviors related to sales.

On the work done by Zadeh,

Sepehri and Farvaresh, three different approaches were used to predict medical

drug sales. The first approach used an ARIMA model to forecast time series; the

second approach presented a hybrid neural network to forecast the series

through average sales of previous drugs, for each one; the third approach used

a hybrid neural network for time [4]. Through this work, it was possible to see

that the use of hybrid neural networks increases the accuracy of predictions,

as it is able to model non-linear patterns. The present work does not use

hybrid neural networks to model non-linear behaviors, which can be considered a

disadvantage.

5

CONCLUSIONS

With an increasingly

competitive business environment, companies are looking to improve their

operations so that profit is optimized to reduce waste. Companies have invested

in decision support systems to explore scenarios based on the historical data

of their transactions. This way, these systems make it possible to extract

information through large volumes of data to provide insights.

In this work, the ensemble

model was chosen to combine prediction algorithms in order to improve the

performance of predictors. This research presented the proposed ensemble model

that used the averages of the classical algorithms to improve performance, but

this approach did not obtain the expected result. In fact, this approach had

very similar results as classical models independently.

This research shows really

similar results for times series forecasting and ensemble method for optimizing

sales forecasts. Also, it is worth noting that all methods applied in this

research obtained a gain up to 6% of precision compared to the current

technique used by Azure Company for sales forecasting.

As future work, a

comparison with a trainable ensemble model is planned in order to obtain better

results than the proposed approaches in this article. Another possible future

work is the use of neural networks to more accurately obtain non-linear

behaviors and possibly observe the relationship between variables that may

impact sales. Regarding the ARIMA model, a possible improvement of the model

can be done using the SARIMA models, which are useful models for databases with

seasonal behavior. In addition, another important technique will be to train

the database with previous years and predict future years.

REFERÊNCIAS

[1] PASSARI,

A. F. L. Exploração de dados atomizados para previsão de vendas no varejo

utilizando redes neurais. 2003. Tese de Doutorado. Universidade de São

Paulo.

[2] YU, X.; QI, Z.; ZHAO, Y.. Support vector

regression for newspaper/magazine sales forecasting. Procedia Computer

Science, v. 17, p. 1055-1062, 2013.

[3] TRIAYUDI, A. et al. Data mining

implementation to predict sales using time series method. Proceeding of the

Electrical Engineering Computer Science and Informatics, v. 7, n. 2, p.

1-6, 2020.

[4] KHALIL ZADEH, N.; SEPEHRI, M. Mehdi;

FARVARESH, H. Intelligent sales prediction for pharmaceutical distribution

companies: A data mining based approach. Mathematical Problems in

Engineering, v. 2014, 2014.

[5] ENCHEVA, Sylvia et

al. Decision support systems in logistics. In: AIP Conference Proceedings.

American Institute of Physics, 2008. p. 254-256.

[6] CALADO, R. B. Mineração

de Dados Não Estruturados Utilizando uma Combinação de Redes Complexas e

Ensemble Dinâmico. 2019. Dissertação de

Mestrado. Universidade de Pernambuco.

[7] TIAN, Huiren et al. An LSTM neural network for improving

wheat yield estimates by integrating remote sensing data and meteorological

data in the Guanzhong Plain, PR China. Agricultural and Forest Meteorology,

v. 310, p. 108629, 2021.

[8] SWARAJ, Aman et al.

Implementation of stacking based ARIMA model for prediction of Covid-19 cases

in India. Journal of Biomedical Informatics, v. 121, p. 103887, 2021.

[9] VICARI, et al. Modeling of the 2001

lava flow PAVLYSHENKO, Bohdan M. Machine-learning models for sales time

series forecasting. Data, v. 4, n. 1, p. 15, 2019.

[10] PASSARI,

Antonio Fabrizio Lima. Exploração de dados atomizados para previsão de

vendas no varejo utilizando redes neurais. 2003. Tese de Doutorado. Universidade

de São Paulo.

[11] CLEMENTS,

Michael P.; SMITH, Jeremy. The performance of alternative forecasting

methods for SETAR models. International Journal of Forecasting, v. 13,

n. 4, p. 463-475, 1997.

[12] GARDNER JR, Everette S. Exponential

smoothing: The state of the art. Journal of forecasting, v. 4, n. 1, p.

1-28, 1985.

[13] JABBAR, H.; KHAN,

Rafiqul Zaman. Methods to avoid over-fitting and under-fitting in supervised

machine learning (comparative study). Computer Science, Communication and

Instrumentation Devices, p. 163-172, 2015.

[14] CHAI, Tianfeng;

DRAXLER, Roland R. Root mean square error (RMSE) or mean absolute error

(MAE)?–Arguments against avoiding RMSE in the literature. Geoscientific model development, v. 7, n. 3, p.

1247-1250, 2014.

[15] HIRAKATA, Vânia Naomi; MANCUSO, Aline Castello Branco;

CASTRO, Stela Maris de Jezus. Teste de hipóteses: perguntas que você sempre

quis fazer, mas nunca teve coragem. Vol. 39, n. 2, 2019, p. 181-185, 2019.